Marin County Real Estate Market Report

November 2025

November 2025 Marin County Real Estate Market Report

Marin County Market Overview: A Complex but Resilient Fall

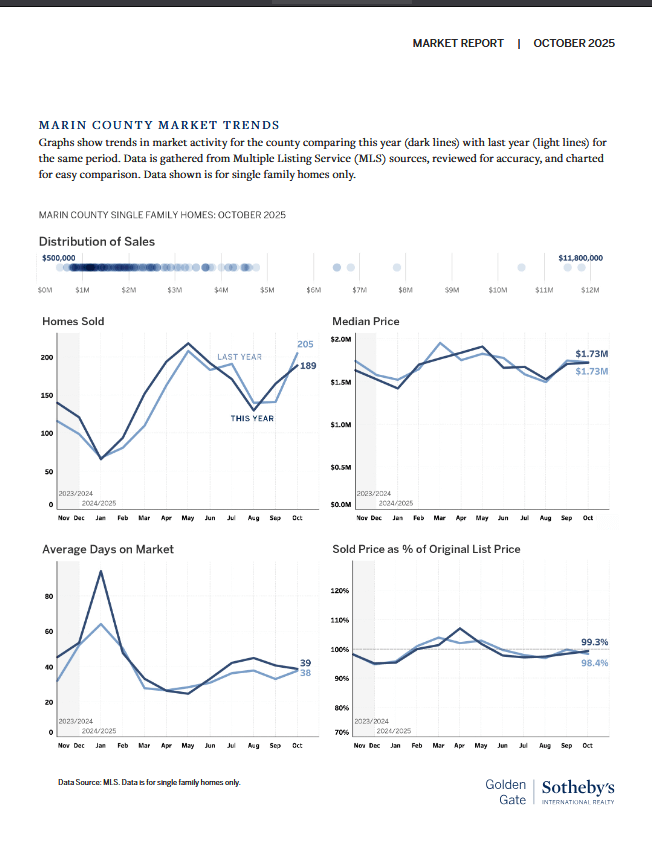

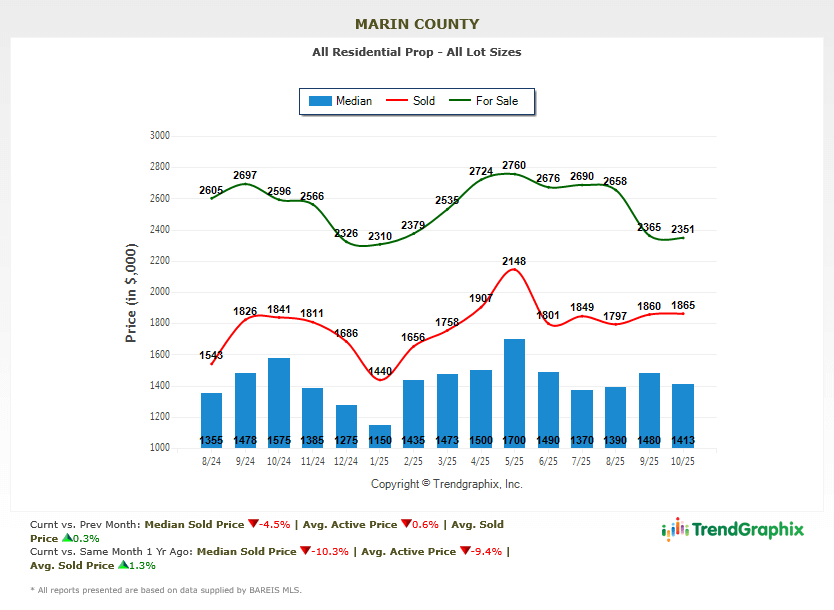

October brought a noticeable shift in Marin County’s housing metrics, reflecting both seasonal patterns and evolving buyer behavior. Inventory continued to run high, with 505 homes for sale, up 7.4 percent year-over-year, giving buyers more options than we’ve seen in the last several fall markets. Homes spent an average of 50 days on market, nearly identical to last year’s 49, indicating that well-positioned and well-priced homes still attract strong attention even in a more balanced environment.

The most striking number in the October data is the median sold price, which came in 10.3 percent lower year-over-year. While that may appear dramatic, it’s important to understand what’s behind it. Both average sold price (up 1.3 percent) and price per square foot (up 2.8 percent) increased year-over-year, and the Bay Area regional report—which evaluates single-family homes only—shows Marin’s median nearly flat (down 0.3 percent) for the same period. This combination strongly suggests a shift in the mix of homes sold in October rather than any widespread decline in property values. Simply put, more sales occurred at lower and mid-tier price points this October compared to last, while higher-end activity was concentrated earlier in the year.

On the demand side, the number of homes sold dipped slightly (down 1.3 percent year-over-year), but pending sales surged 23.8 percent, reflecting renewed buyer engagement heading into the holiday season. Months of inventory rose to 3.1, up 9.6 percent year-over-year, signaling a market that remains balanced with a slight tilt toward buyers—yet still stable enough for sellers who prepare and price strategically.

Overall, the fall market continues to show resilience, even as broader economic uncertainties play out. The fundamentals remain solid: buyers are active, inventory is healthy, and well-presented homes continue to achieve excellent results.

Broader Context: Rates, Market Volatility, and Bay Area Tech Momentum

The broader economic environment this fall continues to evolve in ways that influence buyer behavior and confidence. Mortgage rates have eased slightly following the Federal Reserve’s first rate cut in nearly two years, with the average 30-year fixed rate now in the low 6 percent range. While still higher than the unusually low rates of the past decade, these levels are far from the peaks seen in the early 2000s and nowhere near the double-digit borrowing costs of the 1980s. The recent decline has helped some buyers re-enter the market and improved overall affordability compared to earlier this year.

Financial markets have been unsettled in recent weeks, with stocks experiencing sharp swings as investors react to mixed earnings guidance and shifting expectations about future monetary policy. Inflation continues to trend gradually downward, and while the timing of any additional rate cuts remains uncertain, the general direction is toward a more accommodating environment in 2026.

In the Bay Area, the tech sector continues to show resilience. Hiring has strengthened in artificial intelligence, cybersecurity, cloud computing, and data infrastructure, and venture capital investment in AI remains exceptionally strong. Early signs of the IPO window reopening have added liquidity for certain buyer segments, particularly those connected to high-growth firms. These trends are beginning to influence the housing market in San Francisco and Silicon Valley and tend to reach Marin with a modest lag.

This Month’s Headlines

- Mortgage rates eased into the low 6 percent range after the Federal Reserve delivered its first rate cut in almost two years.

- Inflation continued to moderate, giving the Fed room to adopt a more accommodative stance in 2026 depending on economic conditions

- Stock markets experienced significant volatility as investors reacted to shifting guidance and global uncertainty.

- Venture capital investment in artificial intelligence and related technologies remained strong, with the Bay Area continuing to attract a major share of national funding.

- Tech hiring expanded in AI, cloud computing, and data roles, supporting buyer activity across the region.

- Early signs of the IPO window reopening improved liquidity for certain buyer groups, especially those in San Francisco and Silicon Valley.

- Marin’s inventory remained higher than last year, offering buyers more choice as we head into the holiday season.

Featured Sales in My World

This fall has been an active and rewarding season across Marin and the broader Bay Area. Several notable sales closed in October and early November, reflecting strong buyer engagement even as inventory remains elevated.

In San Rafael’s Gerstle Park neighborhood, 260 Clorinda Avenue sold for $1,825,000, closing $100,000 over asking. Nearby, 102 Clorinda Avenue closed at $1,455,000. In Belvedere, my listing at 11 Crest Road sold for $4,350,000, and my San Francisco listing at 739 10th Avenue previously sold for $780,000 over asking in just one week. Today, 1245 Sobre Vista Drive in Sonoma went into escrow after attracting significant interest.

For those seeking something off-market, 16 Sunny Drive in San Anselmo remains available and offers a rare combination of charm, privacy, and proximity to downtown. And while the year may be winding down, it is never too early to begin planning a spring 2026 listing. Many of my most successful sales begin months in advance with thoughtful preparation, strategic updates, and careful timing.

A Season of Gratitude

As we move into November and the season of gratitude, I want to take a moment to thank my clients, neighbors, and community for your continued trust and support. This is one of my favorite times of year—not just for the crisp fall weather and gatherings with family and friends, but because it offers a chance to reflect on the relationships that make my work so meaningful. Every home I help sell, prepare for the market, or privately position off-MLS represents a partnership built on confidence and collaboration, and I am deeply grateful for that.

To everyone who has trusted me with your home sale or purchase this year, thank you. And if you’re beginning to think about listing your home in the spring, it is never too early to start the conversation. Fall and early winter are ideal times to plan strategy, updates, staging, photography, and timing for a successful 2026 launch.

How Can I Help?

Marin County continues to offer a compelling combination of lifestyle, location, and value. I am always happy to talk about the Marin County real estate market. Call or text me at 415-847-5584 for a personalized report for your home and neighborhood, or to discuss the best strategy for making your real estate goals a reality.

Now Available!

Check Out My Sizzle Reel!

From the Golden Gate Sotheby’s Bay Area Market Report…

INCREASED INVESTMENT

In a typical year, there is an uptick in activity in October before the market settles into the holiday season, and this year was no exception. Economic conditions in the region remain mixed, with reports of business expansions as well as tech industry layoffs. The federal government shutdown continues to delay the release of economic data, clouding not only the economic picture but also delaying paychecks and assistance programs. However, highlighting increasing economic activity in the region, more than $140 billion in venture capital funding was deployed in the SF Bay Area during the first nine months of 2025, the largest amount for any year on record and 42% more than the amount of capital deployed in all of 2024. The continued expansion of artificial intelligence and other innovative industries should support growth across the broader SF Bay Area economy.

INVENTORY DOWN, SALES INCREASE

After inventory increased for much of the past year, the number of active listings in the SF Bay Area decreased significantly in October amid strong sales activity. More than 7,0o0 homes were on the market across the SF Bay Area last month, an 11% decrease from the previous month. Fewer homes were on the market in every SF Bay Area county. Inventory tightened rapidly in Marin and Santa Clara counties. In San Francisco, the inventory of homes on the market decreased by nearly 10%.

Meanwhile, the number of closed sales surged in October and surpassed the spring peak. Total sales decreased by 1.5% in October to 3,928 sales. The largest increase in sales was in San Francisco. Much of the increase stemmed from a greater number of sales in neighborhoods closest to the Financial District and eastern waterfront, highlighting the desire for homebuyers to locate closer to workplaces.

PURCHASE DEMAND FUELS SALES

Closed sales also increased by more than 10% month-over-month in Alameda, Marin, San Mateo and Sonoma counties. Santa Cruz County was the only market where sales declined. More broadly, homes in upper price tiers drove much of the increase in sales activity-a continuation of the trend from the past year. More than 300 homes sold for more than $3.5 million in October, an increase of more than 20%. Sales of homes in the $1.25 to $3.50 million price range also increased by 10%, while the number of homes sold for less than $1.25 million increased by 7% in October. Increasing sales across the price spectrum highlighted the strength of purchase demand amid economic headwinds.

The ratio of active listings to closed sales-referred to as months of inventory-was less than two in the SF Bay Area in October. Compared to housing markets across the country, where months of inventory exceed three or four months, the pace of SF Bay Area home sales remained strong. There was less than one month of inventory remaining in San Francisco, and less than 1.5 months remaining in San Mateo and Santa Clara counties.

SALES PACE QUICKENS

In another sign of demand for well-priced homes, average days on market decreased and more homes sold for more than the asking price. Homes that sold in October spent an average of 35 days on the market, which was 3 days less than last month and generally on par with the historical average.

In addition to homes selling relatively quickly, nearly half of sales in the SF Bay Area sold for more than the listing price, a five percentage point increase from last month. However, this metric was bifurcated by geography and highlighted the strong demand for homes near major job centers. A greater share of homes sold for more than the asking price in the inner SF Bay Area, particularly San Francisco, while the share was less than 30% in four of the outer SF Bay Area counties.

LOOKING AHEAD

As the market transitions into the winter season some housing indicators may begin to slow even as tailwinds remain. The AI boom and the billions of investment dollars deployed in the region should bolster economic growth as well as some hiring. The potential for lower mortgage rates is increasing, though this is not a certainty in the coming months. Utilization of adjustable rate mortgages is also rising, helping to offset some of the decreased affordability caused by rising prices and higher conventional mortgage rates. The strength of demand indicators and improvement of sales activity highlight the depth of the demand pool in the SF Bay Area and potential for an active end to the year.

What My Clients Are Saying…

Marin Real Estate Market Stats

Marin County Real Estate Market Report Charts

(click any slide to enlarge & launch slideshow)

“For Sale” vs. Sold Home Prices vs. Median Home Prices

Marin Home Prices List Price vs. Sold

Marin County Months of Inventory Based on Closed Sales

Average Price Per Square Foot

Marin County Number of Homes on the Market

I hope you have found my Marin County Real Estate Market Report informative. Please feel free to add your comments, questions or suggestions in the comments section below. If I may be of any assistance in helping you attain your real estate goals, please call or text me at 415-847-5584 and I will be in touch right away.

Would you like to see this data for your town only?

I am also excited to announce that my website now has new real estate market reports by town with more coming soon. Please check these out:

Belvedere Real Estate Market Report

Corte Madera Real Estate Market Report

Fairfax Real Estate Market Report

Kentfield Real Estate Market Report

Larkspur Real Estate Market Report

Mill Valley Real Estate Market Report

Novato Real Estate Market Report

San Anselmo Real Estate Market Report

San Rafael Real Estate Market Report

Tiburon Real Estate Market Report

These are all accessible from the “Market Reports” menu item here on my website at any time.

About the Author

Thomas Henthorne is consistently top-ranked, award-winning real estate agent in Marin, helping people buy and sell homes for almost a decade. He writes the #1 real estate blog in Marin County and is a frequent speaker on panels at industry gatherings.

He may be reached at 415-847-5584.

Leave a Comment

What do you think?Please leave your comment below!