Solar Leases Can Complicate Home Sales

As a real estate agent here in Marin County, California, many of the homes I represent for buyers and sellers have solar electric panels on the roof. Some also have hot water solar systems for heating swimming pools, however those are less common. Having handled a number of transactions with homes with leased solar, I now put solar leases in the “likely a challenge” category when evaluating a property.

What is a Solar Lease?

There are two ways to install a solar electric system on your home: to purchase the system outright, or to lease a system from a company that specializes in that business. Solar leases are an attractive option for those who want the environmental benefits that come along with solar energy but do not want the large cash outlay that may come with purchasing a solar system outright. (Note I said “may” as in some cases solar installers offer financing with low down payments.)

When you lease a system, you sign a contract – often 20 years – with a company that purchases and installs a system on your roof. You then pay that company a monthly fee for the electricity you use, and that company sells any extra energy back to the utility. In many cases you will not receive the benefit of extra electricity generated. That company also reaps the full benefit of the tax credit when purchasing a system – currently a 30% credit on your taxes.

In turn, the solar leasing company maintains the system if it breaks, and promises a set fee (which may increase a fixed amount each year of the lease) for electricity, shielding you from increases in the cost of electricity for a decade or more.

What are the Advantages of Leasing Solar?

The main advantage of leasing instead of purchasing is there is no initial capital outlay the way there usually is when one purchases a system. Homeowners are able to “go solar” without a capital investment, and have a predictable cost of energy for the duration of the solar lease. In addition, homeowners do not need to worry about maintenance — if the system experiences a problem, the leasing company will come fix it, most often without a charge.

What are the Disadvantages of Leasing Solar?

- Lien on Your Property: This will be seen as a “cloud” on the title by many prospective buyers. In order to protect their equipment and ensure full payment of the lease contract, the solar lease company puts a lien on your property which is recorded on the title. This can significantly complicate the sale of your home. Not all prospective buyers will be interested in assuming the lease or they may not qualify to do so per the solar company’s requirements. If a buyer will not or can not assume the lease then the lease must be paid off by either the seller or the buyer. In general, buyers do not like assuming leases that someone else created and they don’t like having liens on the property.

- Large Payoff Amounts That Most Often Exceed The Cost of a System: Solar leases are often structured with low down payments and low initial monthly payments. However, getting out of the lease is another matter. If the lease term is not up, home sellers have three options: ask their buyer to assume the lease, which requires a credit check and transfer costs; or buy the system outright which in my experience is more than the system would have cost in the first place; or make the remaining lease payments and pay termination charges. The solar leasing company then has the option of leaving the panels on the roof or removing them. This usually becomes a point of negotiation that will complicate and sometimes even kill a deal.

- Another Entity Involved in Your Sale: Some companies are better than others, but in my experience many solar leasing companies are not very responsive and/or sensitive to the timelines and time constraints involved in selling a home. Buyer’s agents and their clients need information about the lease and the system, lenders require documentation on the lease in order to get the loan approved and title companies need information and documents for closing. Sellers are at the mercy of the solar company to provide this information in a timely manner. This is often not the case which adds more stress to an already stressful situation and can often cause delays in closing and/or jeopardize the transaction. I have literally spent hours on hold trying to get that information for buyers.

- Lack of Tax Credit: The company that leases solar to homeowners gets the full tax credit on the system, which currently is a whopping 30% off the cost of a rooftop system.

- The Leasing Company Will Protect Their Investment: I have seen many solar lease contracts in my day, and most of them include a provision that the homeowner is responsible for maintaining optimal conditions for solar generation. That means if the panels are dirty, the homeowner is most likely responsible for cleaning them. If trees block the solar panels, the homeowner must trim them, and the solar leasing company can charge the homeowner for lost electric generation until that is performed.

What Should Sellers Do Before Selling a Home with Leased Solar?

The biggest mistake I have seen sellers and their agents make is not including all the lease-end options in the initial property disclosures packet. Figuring out the lease end options can be challenging during escrow, when inspections and financing contingencies are in process. Buyers do not like a $25,000 surprise in escrow — and will likely ask the seller to absorb that cost. You do not want to put your house on the market without having this information.

Ideally, sellers should pay off the system and convert the leased system into an owned system prior to putting the home on the market. If that is not possible, then all the costs should be disclosed, and the seller’s agent should have time set aside to work with the solar leasing company to handle the transfer.

Advice for Buyers Considering a Home with Leased Solar

A leased solar system does not need to be the end of the deal, but it is important that buyers go into it fully informed. The buyers should get a full copy of the leasing agreement, along with payoff costs, maintenance charges and termination charges. If buyers’ credit scores are above 700, it is likely they can assume the lease, but that is not a guarantee.

I recommend to my buyers that they negotiate having the lease paid off by the seller or negotiate a credit to allow them to do so later. There may be some instances where assuming the lease makes sense, although more times than not, it is always better to own a home free and clear without a solar lien against it.

Don’t Let This Scare You Away from Solar Energy

I have a purchased solar electric system on my home and I love it. The system paid for itself in 6 years, and our electric bill went from being $200-500 per month to $500 per year. So far it has not required any maintenance or servicing and is still generating the same amount of electricity as the day it was installed. Learn more about my experience purchasing solar in Marin County here.

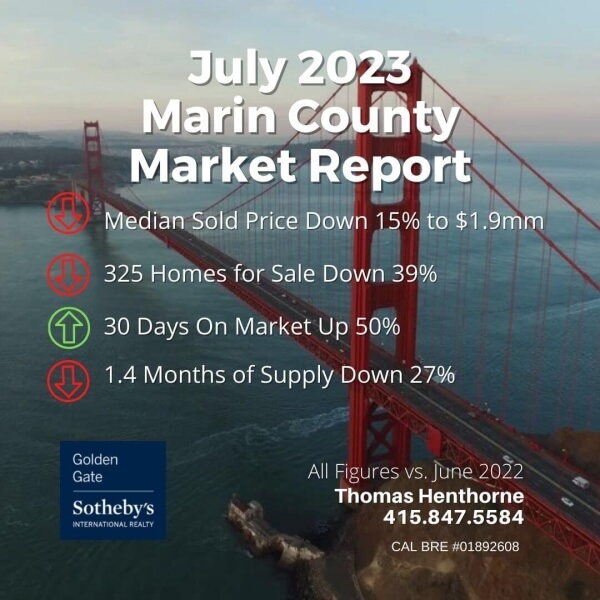

As a Marin County real estate agent, I am happy to help answer your questions about buying and selling homes in the Bay Area. Please call or text me at 415-847-5584 anytime.

Further Reading…

Homeowner’s Guide to Going Solar (US Department of Energy)

Planning a Home Solar Electric System (US Department of Energy)

Solar Energy in Marin County: My Own Experience (Thomas Henthorne)

About the Author

Thomas Henthorne is consistently top-ranked, award-winning real estate agent in Marin, helping people buy and sell homes for almost a decade. He writes the #1 real estate blog in Marin County and is a frequent speaker on panels at industry gatherings.

He may be reached at 415-847-5584.

Excellent article! A real eye opener! Thank you.

Thank you, Patti! I am glad you found it helpful.

This was very helpful ! I’m in Glenn county and I had to qualify to take over a solar loan to buy not lease the system on my home , it was a last minute nightmare and not the seller or the title company or the realtor were clear on the rules. No one can tell me if the solar credit for installation was claimed and over been going around in circles. Yes, it saves me $100’s in electric bills , however I pay $197.00 a month and it was only Installed less than a year before they sold the house to me .

I am so glad you found it useful. They can make sense for some people who are in their forever homes but for many it is not the best choice. Thank you Christina and best of luck on your sale.